Understanding Forex Trading: A Comprehensive Guide

Forex trading, short for foreign exchange trading, is the process of exchanging one currency for another with the aim of making a profit. It’s one of the largest and most liquid markets in the world, with an average daily trading volume exceeding $6 trillion. Traders can profit from the fluctuations in currency values, and this article aims to explain the essentials of forex trading, including its mechanisms, strategies, and tools. For more information, visit forex trading explained FX Trading UZ.

What is Forex Trading?

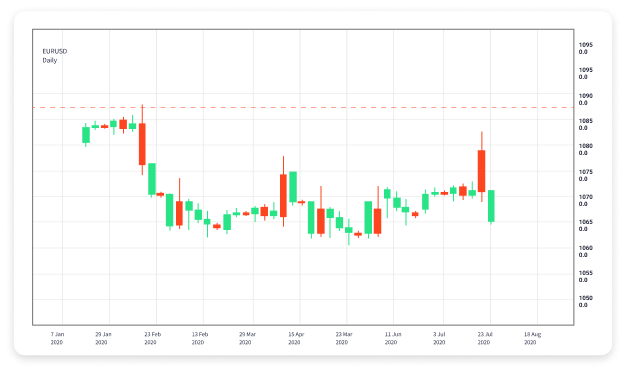

Forex trading involves the buying and selling of currency pairs, which are the basis of the forex market. Each currency is quoted in pairs, such as EUR/USD (euro against U.S. dollar), where the first currency is referred to as the base currency and the second as the quote currency. The value of the pair represents how much of the quote currency is needed to purchase one unit of the base currency.

The Mechanics of Forex Trading

To engage in forex trading, one typically needs to work with a forex broker who provides the platform to execute trades. Traders can use leverage, which means they can control a larger position with a smaller amount of capital. However, leverage increases both potential gains and potential losses.

The forex market operates 24 hours a day, five days a week. Its continuous operation is due to overlapping trading sessions across major financial centers, including London, New York, Tokyo, and Sydney. This allows traders to react to market news at any time, making it unique compared to other trading markets.

Key Terms in Forex Trading

– **Pips**: Short for “percentage in point,” a pip is the smallest price move that a given exchange rate can make based on market convention.

– **Spread**: The difference between the bid (selling) and ask (buying) price of a currency pair.

– **Leverage**: Allows traders to control larger positions with a smaller amount of capital, increasing both potential profits and potential losses.

Types of Forex Analysis

Successful forex trading often entails a solid understanding of market analysis. There are three primary methods:

1. Fundamental Analysis

This method involves analyzing economic indicators, news reports, and political events that can influence currency values. Traders look at factors such as interest rates, employment data, and inflation to predict future movements in currency prices.

2. Technical Analysis

Technical traders focus on price movements and historical data to forecast future trends. They use various charting techniques, indicators, and patterns to identify potential entry and exit points. Popular tools include moving averages, Relative Strength Index (RSI), and Fibonacci retracements.

3. Sentiment Analysis

This approach gauges the market’s mood or sentiment towards a currency or currency pair. It often involves assessing whether traders are optimistic or pessimistic about future price movements, which can help traders position themselves correctly in the market.

Popular Forex Trading Strategies

There are various strategies that forex traders use to make informed decisions. Some common ones include:

1. Day Trading

Day traders buy and sell currencies within the same trading day, aiming to capitalize on short-term market fluctuations. They generally close all positions before the end of the trading day to avoid overnight risk.

2. Swing Trading

Swing traders hold positions for several days or weeks, seeking to profit from price swings caused by market trends. This strategy often involves a more comprehensive analysis of both technical and fundamental factors.

3. Position Trading

Position traders take a long-term approach, holding onto trades for weeks, months, or even years. This strategy is typically based on fundamental analysis, and traders are less concerned with short-term price movements.

Risks in Forex Trading

Although forex trading offers the potential for high rewards, it is also accompanied by significant risks. Some of the main risks include:

- Market Risk: The risk of losing money due to unfavorable price movements.

- Leverage Risk: While leverage can magnify profits, it can also amplify losses, potentially leading to a significant loss of capital.

- Interest Rate Risk: Changes in interest rates can impact currency values and trading positions.

- Geopolitical Risk: Political events, such as elections or conflicts, can lead to market volatility.

Conclusion

Forex trading is a dynamic and potentially lucrative market, but it requires knowledge, strategy, and discipline. Understanding the basics, employing sound analysis techniques, and managing risks effectively are fundamental for success in this fast-paced environment. While the appeal of large profits can be enticing, a comprehensive understanding is crucial for navigating the complexities of forex trading.